Mid-Year Housing Market Update: A Chilly Spring and Glimmers of Rental Resilience

By Taylor Shultz (who attended the John Burns Research webinar, so you didn’t have to)

If you were hoping for a mid-year housing market pep talk, the John Burns Research team had some sobering news during their recent 2025 Mid-Year Housing Market Update webinar. Rick Palacios Jr., Chris Porter, and Chris Nebenzahl laid out a picture that’s more gray skies than sunshine—at least for the for-sale side of the market.

Let’s start with the big one: for-sale housing. In short? It’s struggling. The team made it clear that they’re likely to lower their forecasts for home sales and housing starts. They entered 2025 already predicting year-over-year declines, and the first half of the year has done little to change their minds. In fact, spring—which is usually a busy season—turned out to be more of a dud than a catalyst for a bright selling season.

Homebuilders seem to agree. They’ve been tapping the brakes on new starts and pulling back on land acquisitions. Why? Weak buyer demand and few signs of a turnaround. Mortgage rates hovering around 7% aren’t helping either. In response, expect builder incentives—think mortgage rate buydowns and design credits—to stick around for a while. In the Sunbelt especially, price cuts are becoming the norm, and the trend could spread if rates stay elevated.

But it’s not all doom and gloom. Over on the rental side, there’s a bit more stability. Apartment supply peaked in late 2024, and with fewer new units coming online, the supply-demand balance is starting to shift in landlords’ favor. Rents are still only creeping up (current growth is a modest +0.6%), but the John Burns team sees potential for a more meaningful recovery ahead—barring a recession, of course. Absorption across all rental sectors remains strong, especially when the affordability challenges of the for-sale product are factored in.

John Burns researchers note that it is twice as expensive to own compared to rent on a monthly basis. That marks the first time since 2006, that the monthly cost of owning an entry level home is more than double the average apartment rent in the U.S. Combined with the fact that mortgage rates are expected to remain higher for longer, and the constraints on for-sale affordability, outsized demand is likely in store for rentals. This shift is already showing up in the multifamily turnover rate, which dropped quickly as the monthly cost to own rose.

Construction is quickly slowing, though continued demand will likely lead to strong future rent growth. Markets in the Northeast, Midwest and the West Coast are performing well, and that’s a trend likely to continue, though there’s no real indicators of future outsized growth. Northern California and the Pacific Northwest are leading the nation, averaging more than two units absorbed for every unit started. Fundamentals in the Sunbelt remain a bit softer due to oversupply, though the light at the end of the tunnel seems to be getting a bit brighter.

Build-to-rent communities are showing mixed results, depending heavily on the region and the specific product type. Some markets are doing fine, others—not so much. But one clear bright spot is single-family rentals. Despite the cyclical rollercoaster in multifamily and build-to-rent, the single-family rental market keeps chugging along with its usual steady growth.

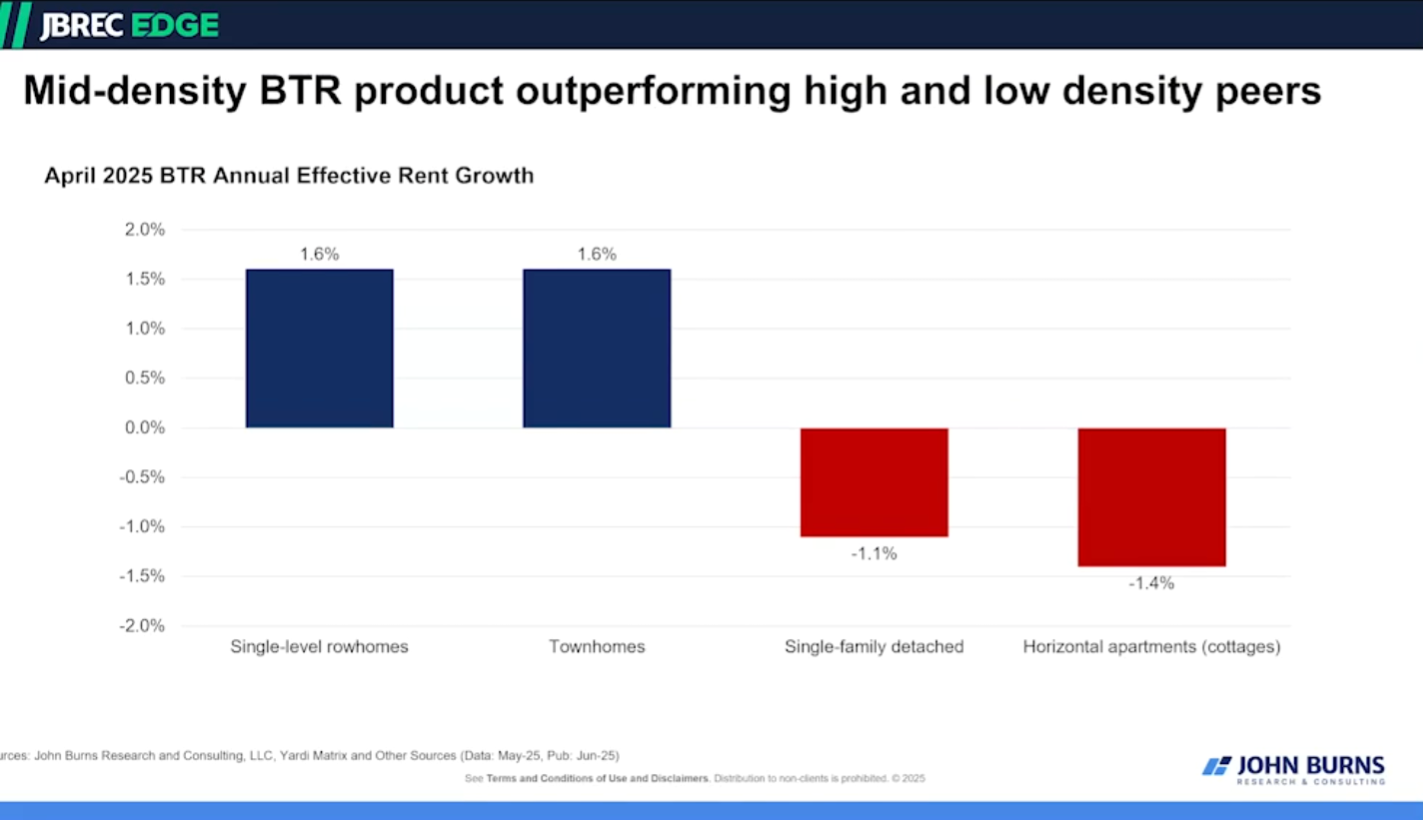

The mid-density BTR product is outperforming high- and low-density product types. In fact, John Burns reports that both single-level rowhome and townhome BTR projects experienced 1.6% annual effective rent growth in April 2025. Turning to the occupancy numbers, rowhome and townhome BTRs outperformed their peers, with Single-level rowhomes achieving 96.5% stabilized occupancy in April 2025 and townhomes hit 95.1% occupancy during the same period. Single-family detached projects hit 94.7% and cottage-style communities recorded 93.2% occupancy.

So, what’s the takeaway? If you’re in the for-sale market, buckle up for a tough ride through the second half of the year. If you’re in rentals, especially single-family, and specifically the BTR sector, you’ve got a smoother road ahead—for now. As always, stay tuned. The second half of 2025 could still throw a curveball.